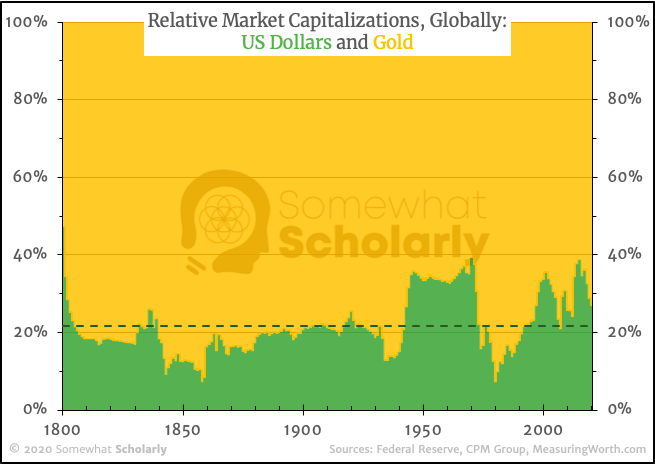

The long-term (220-year) average ratio of market capitalizations is 21.7% Dollars to 78.3% Gold.

The average pre-Fed (pre-1914) ratio is 18.2% to 81.8%.

The average post-Fed (post-1914) ratio is 25.3% to 74.7%.

The all-time-maximum dollar ratio was 39.1% in 1970, immediately before a 10-year bull market in the dollar price of gold (25x), which lowered the dollar ratio to 7.2% in 1980; incidentally, this is the dollar's all-time-minimum ratio.

The second-highest dollar ratio was 38.6% in 2015. If the ratio reverts to the historical low (7.2%), concurrent with a 1970's-like increase in the gold supply (1.2x) and dollar supply (2.4x), then the following values are implied for the year 2025:

- Monetary base: $9.17 trillion

- Gold supply: 6.19 billion ounces

- Gold market capitalization: $118.6 trillion

- Gold price per ounce: $19,100.00

Worth considering.