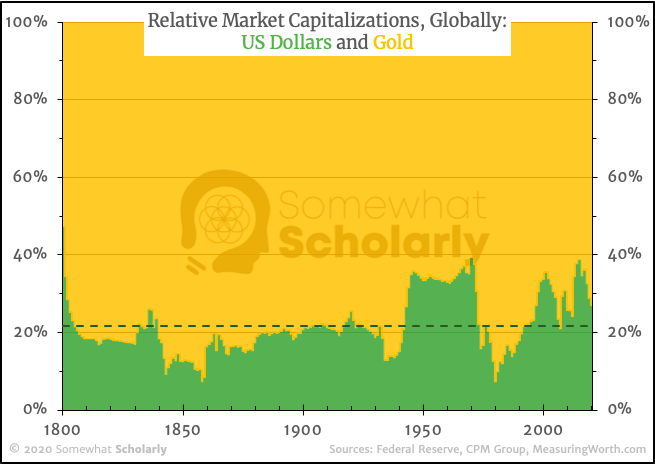

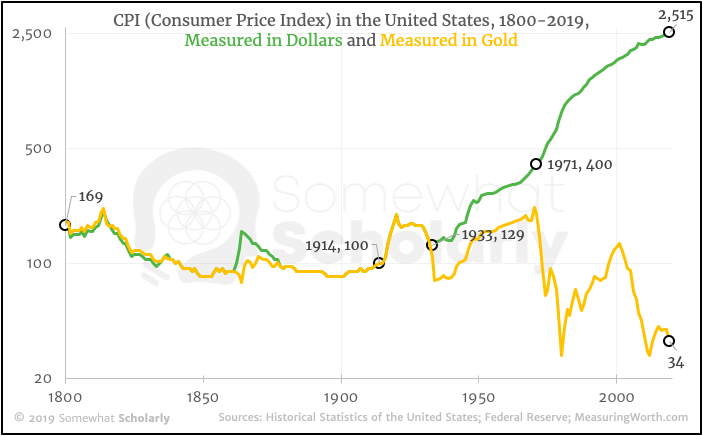

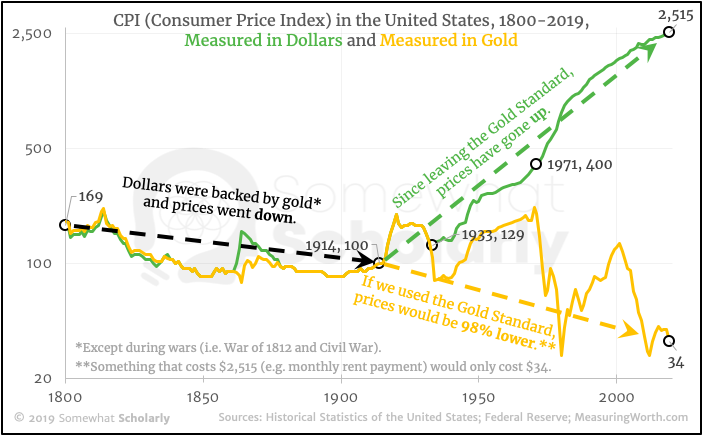

During the last century, the Federal Reserve (a for-profit corporation created in 1913 that acts independently of the government) has printed so many dollars - at such a rapid pace - that it forced the U.S. government to partially abandon the gold standard in 1933, and completely abandon the gold standard in 1971.

The Fed continues to print dollars at an exponential rate, and the effect on the economy is clear: since 1914 (the first year of the Fed's monetary policy), prices have increased more than 25x. [Green line in Chart].

Quite simply, the monetary policy of the Federal Reserve (i.e. printing dollars) has made it much more difficult for the average person to buy things, unless he or she owns gold:

If we divide the CPI by the dollar-price of gold (to measure prices in ounces of gold - i.e. real money that cannot be printed), we find that prices dropped 66% since 1914. In other words: if you own gold (or use money backed by gold), prices go down. [Gold line in Chart].

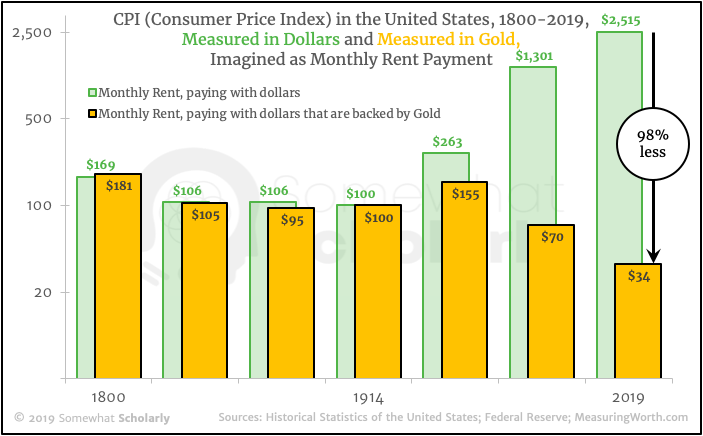

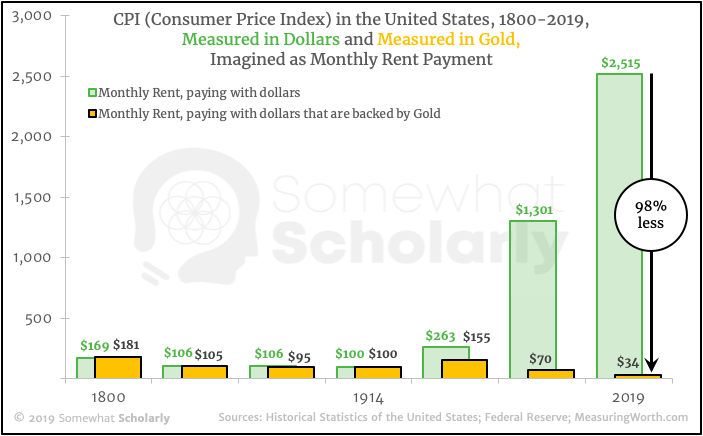

For those who want to imagine what "falling prices" would actually feel like on a personal basis, imagine that the CPI is actually your monthly rent payment. [You could also imagine that it's the price of a gallon of milk, or a loaf of bread, or anything else that you buy weekly, monthly, or yearly]. Would you prefer that these items cost more every week, or less? (It's not a trick question).

Below is the same CPI data from above, but imagined as a monthly rent payment.

Notice that there's really "no difference" between the dollar-price of rent and the gold-price of rent for over a hundred years (i.e. they both get cheaper, slowly, at about the same rate). This pattern changes abruptly in 1914 (i.e. the first year of the Federal Reserve's monetary policy), when the two prices start to diverge wildly: